- chainEDGE Community

- Posts

- Your Ultimate chainEDGE Guide

Your Ultimate chainEDGE Guide

Gm Degen,

chainEDGE has now been publicly live for around a year and we’ve made significant strides in creating a “swiss army knife” tool for onchain crypto traders. We’ve come a long way since being purely just an ETH onchain analytics tool, and I wanted to briefly go over some of the newer features, how they work and how to use them effectively. PS, the onchain market is back alive and we’re running a one time 25% off promotion for annual subscribers to take advantage of by using code codewiz25pctoff.

I’m also hosting a livestream going over this tomorrow at 1:30pm EST.

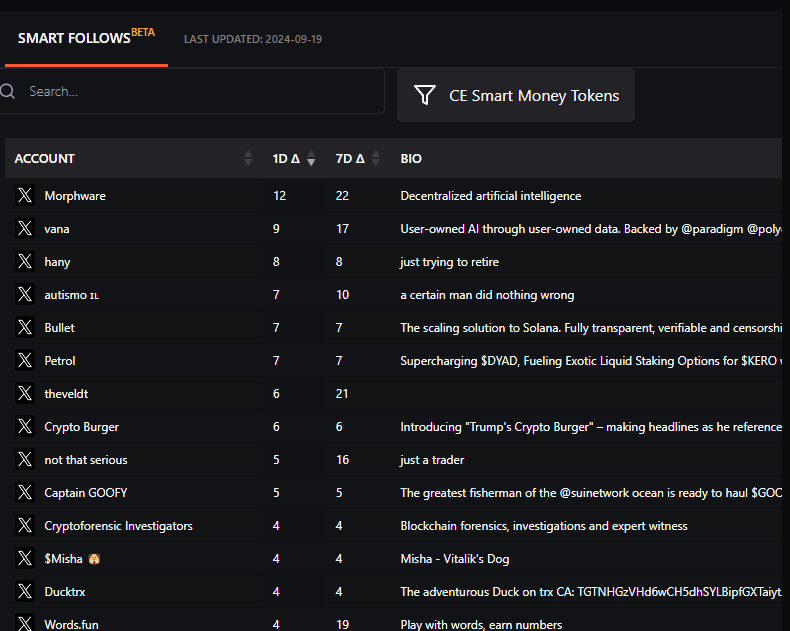

1. Smart Follows - For hyper online traders, the smart follows feature can help find upcoming launches, trending projects and potential presales (hint you can search for “presale” in the search bar and they should pop up if one is ongoing). Other products charge $100 - 1,000/month for this type of feature and we built it and included it for no additional cost within chainEDGE. We built a database of ~500 CT accounts that were early to major token winners and narratives, and this feature tracks what accounts they are following on a 1d and 7d basis.

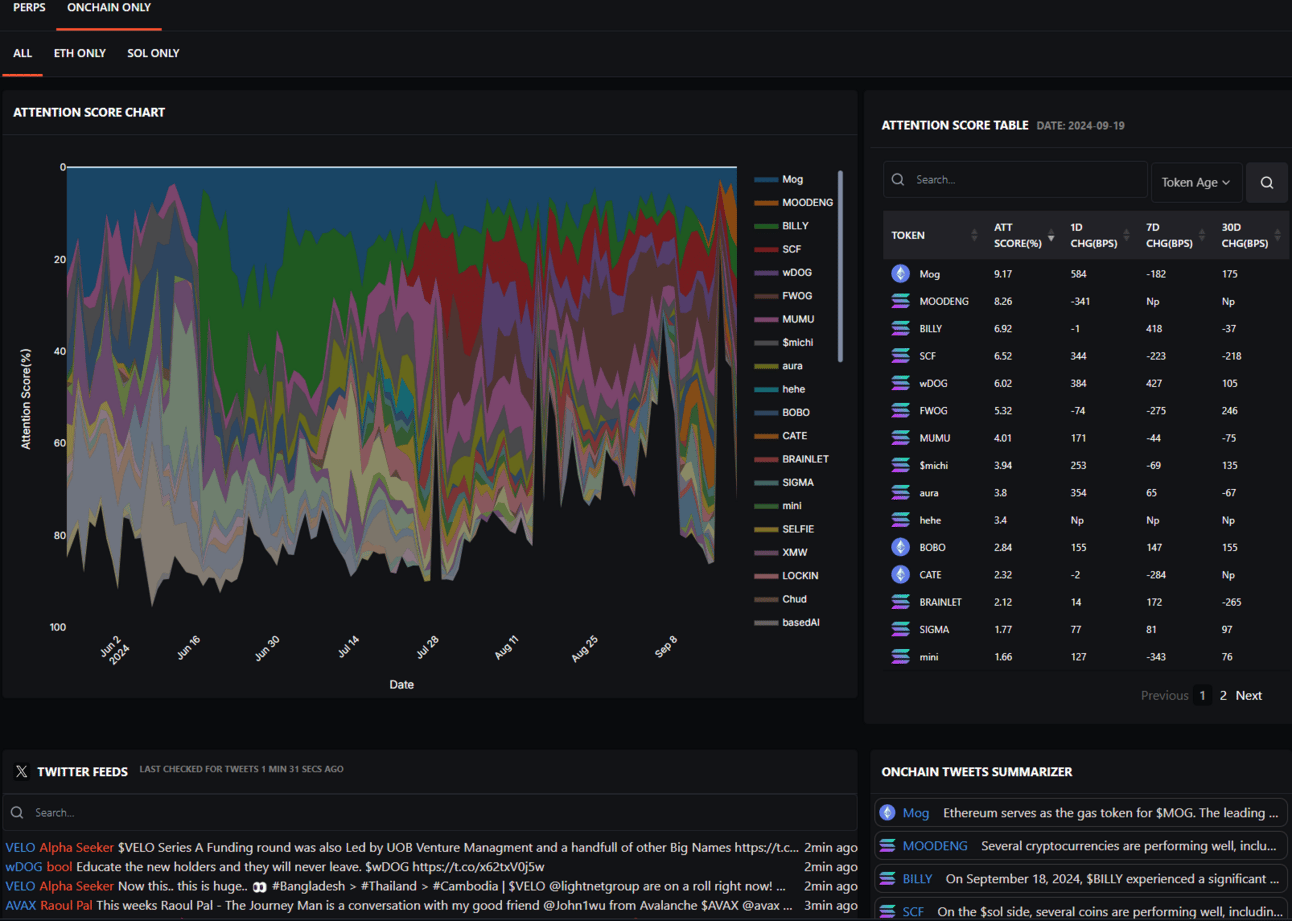

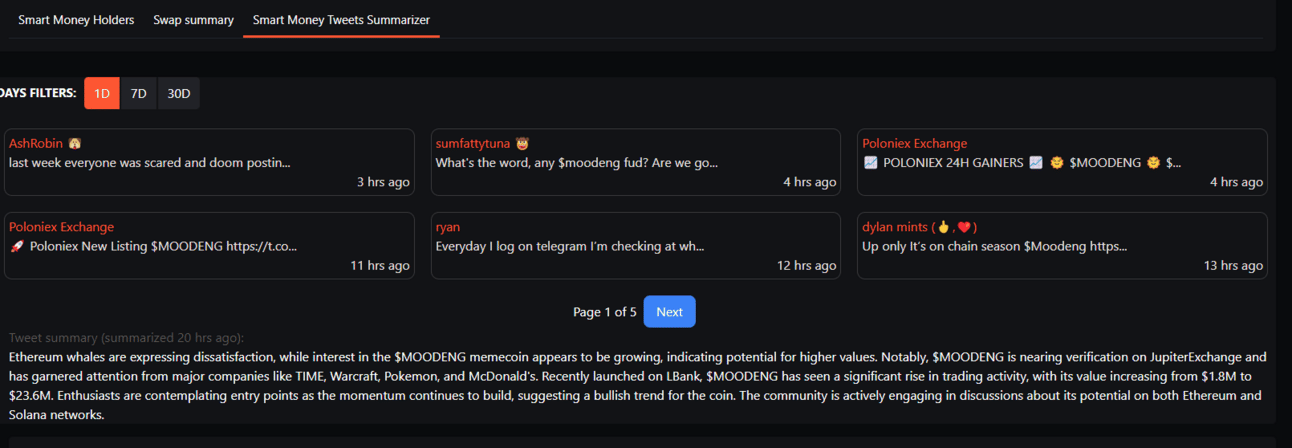

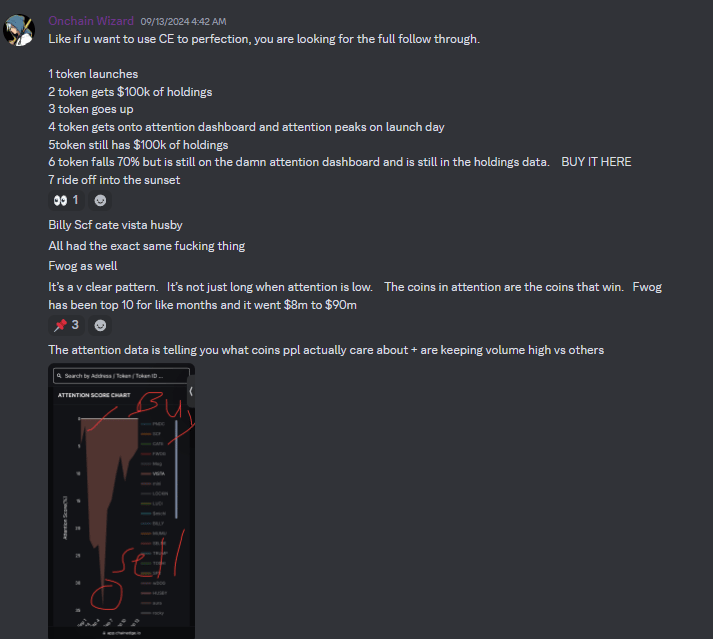

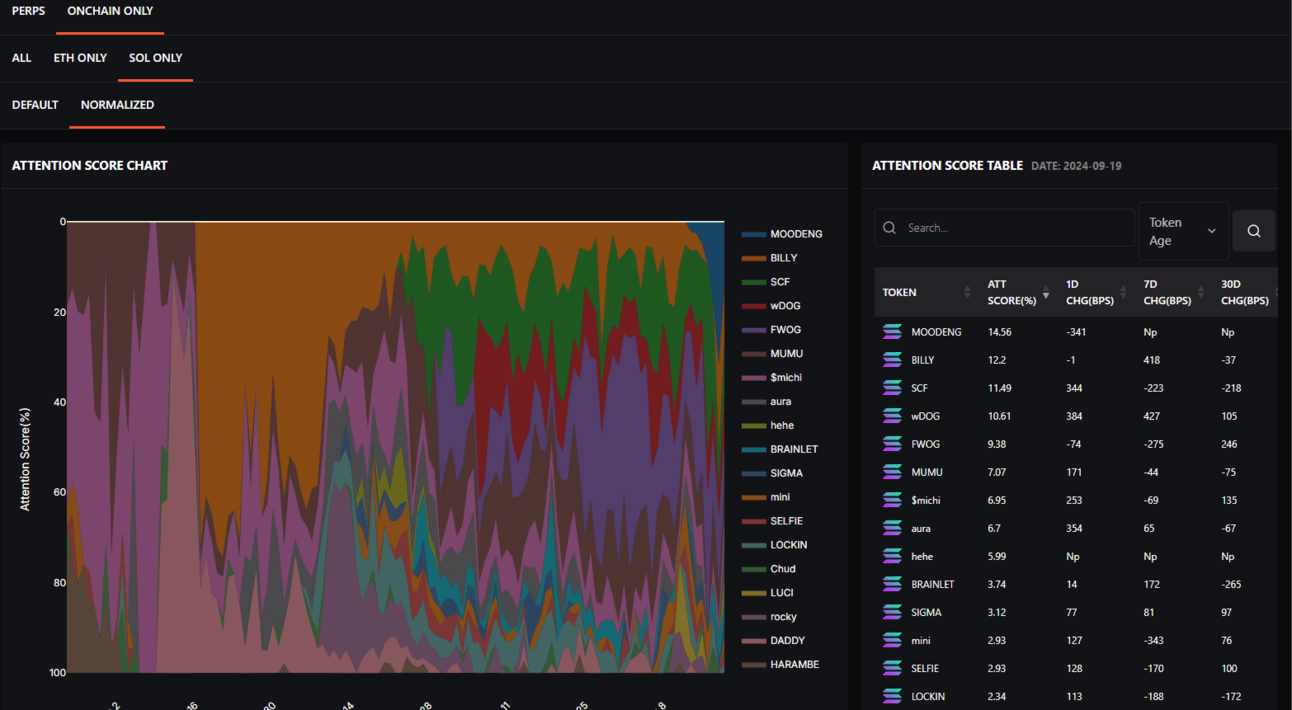

2 - Attention Score - This is one of my favorite features for monitoring where the market’s attention is, both from an onchain and perps perspective (the only other tool kind of like this costs $1k/month). The attention score is a formula that combines onchain stats, token trading volume and CT mentions across 10k of the most popular accounts to determine what coins are gaining, losing or retaining attention. When attention swells, usually token prices swell. And at attention peaks, token prices peak. You can isolate each token’s relative attention chart, monitor their 1/7/30d change in attention and can even get summaries of what people are saying about each token (in the bottom right hand corner). Notably these summaries are also on most token pages throughout the terminal.

CT summary for Moodeng.

3 - Early Investors (Beta) - This one is still in process but is worth playing around with. It allows you to look at cross sections of the early holders of successful tokens (in this example Neiro and VISTA) and see what they are buying now. We will also be rolling this feature out for SOL as well.

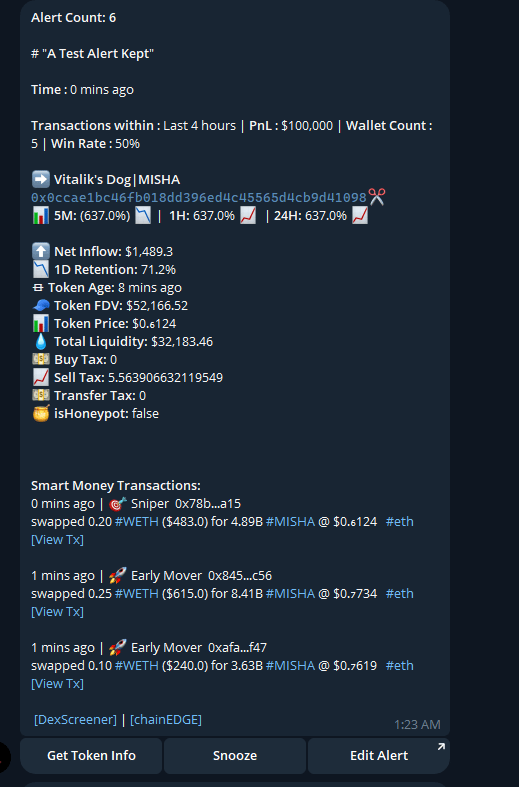

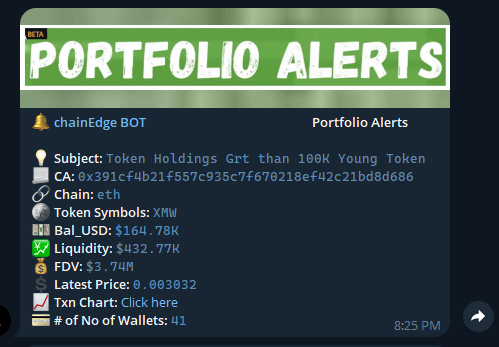

4 - Portfolio Alerts - We just rolled these out and they have been money makers so far. I’ve long been writing about how one of the strongest signals within the platform for $1mm - $20mm runners is $100k+ smart balances on 0-5 day old tokens. We’ve now shipped TG alerts that trigger when this parameter is hit (and all you need to do for receiving them is to have our TG bots set up). With the onchain market heating up, this is a lower risk approach to catching moves in newer tokens vs. being deep in the trenches.

Best chainEDGE Strategies Right Now

For Most New Launches - The alpha stream and custom swap alerts are still the best way to go if you are trying to be early. The hit rate is very market dependent and I’m still not sure the market is perfect for most new launches yet, but this is the best way to be “early”.

For New Launches Going to $20mm+ → For me, it’s not any one single feature that helps identify these. You are instead looking for the follow through of all the different features pinging you throughout the token’s lifecycle. I laid out some thoughts on this below a week ago, but it primarily is using a combo of holdings data and attention data.

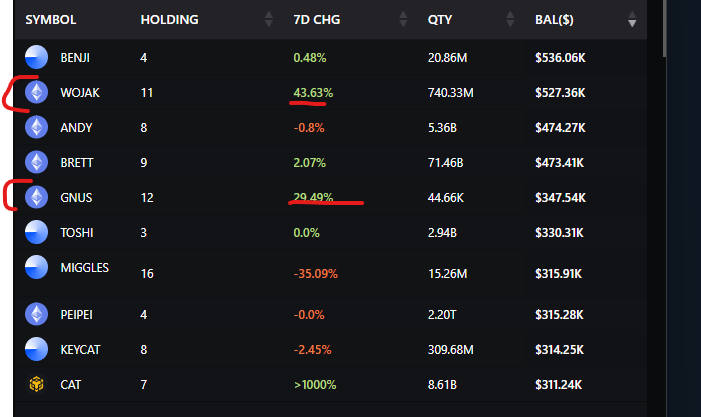

For Trading Older Tokens: Not too dissimilar to the above, the best 2 data sets for these are the Attention data and holdings. When you see abnormal accumulation in tokens, it is usually a pretty good sign, which is what we’ve been seeing in things like WOJAK and GNUS.

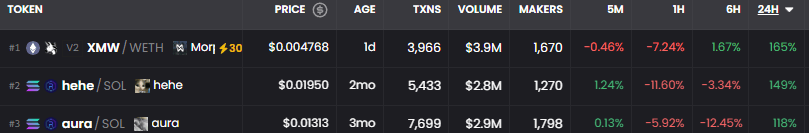

If you look at the best 3 performing tokens over $4mm FDV today, they have been on the “CE radar” and were identifiable.

XMW was our first ETH portfolio alert to go out to all subs this week at $3.7mm.

While hehe and aura were attention leaders (and aura has been a top ~10 SOL attention token for a bit now).

The tool can be complicated, but if you spend a little bit of time to dive in and learn that it is much more than just an onchain analytics tool, it will help you stay on top of everything in the market and most likely be more profitable. PS you can also always check out thedailyedge.com to see me write my thoughts using this data fo free.